Lead generation for home services in 2026: Changing ecosystems, hidden costs, and the demand for exclusivity

Insights

January 30, 2026

·

Sean Diener

|

VP, Performance Partnerships

Consolidation has reshaped the home services industry. Local operators are being absorbed into regional platforms. Regional platforms are being rolled up by private equity. And those PE-backed companies are building multi-brand, multi-market portfolios with centralized infrastructure, sophisticated CRMs, outbound teams, and uniform disposition logic that has changed how leads perform.

While buyers are consolidating, the lead generation ecosystem is undergoing its own transformation. We’re seeing a reshaping of the industry’s definition of lead quality, and at the heart of the discussion is the shared lead.

Exploring the structural shift behind shared leads

Shared leads aren’t new, but their economic role is changing. As more lead-gen shops consolidate, many are adopting a new model where they:

- Buy an exclusive lead from an upstream supplier

- Sell it four times on the backend

- Use the margin to outbid exclusive-only buyers

- Normalize the idea that shared = acceptable

On paper, four buyers splitting the cost of one inquiry looks great, but in reality, it creates a chain reaction that disproportionately harms the operators who run on a national scale. Not because end buyers are naïve or because shared-lead sellers are unethical, but because the structure itself creates operational drag. Exclusive lead models are optimized for the buyer’s performance and shared lead models are optimized for the seller’s economics.

In 2026, we’re seeing the emergence of a shared lead structure built on this kind of inefficiency. In an environment where conversion depends on tight disposition logic, consistent contactability, predictable pacing, accurate probability modeling, and efficient call-center allocation, a shared leads system undermines the entire structure. That’s because shared leads turn the top of the funnel into a speed-to-lead race where the fastest dialer wins over the best customer experience, the strongest brand, and the highest service quality.

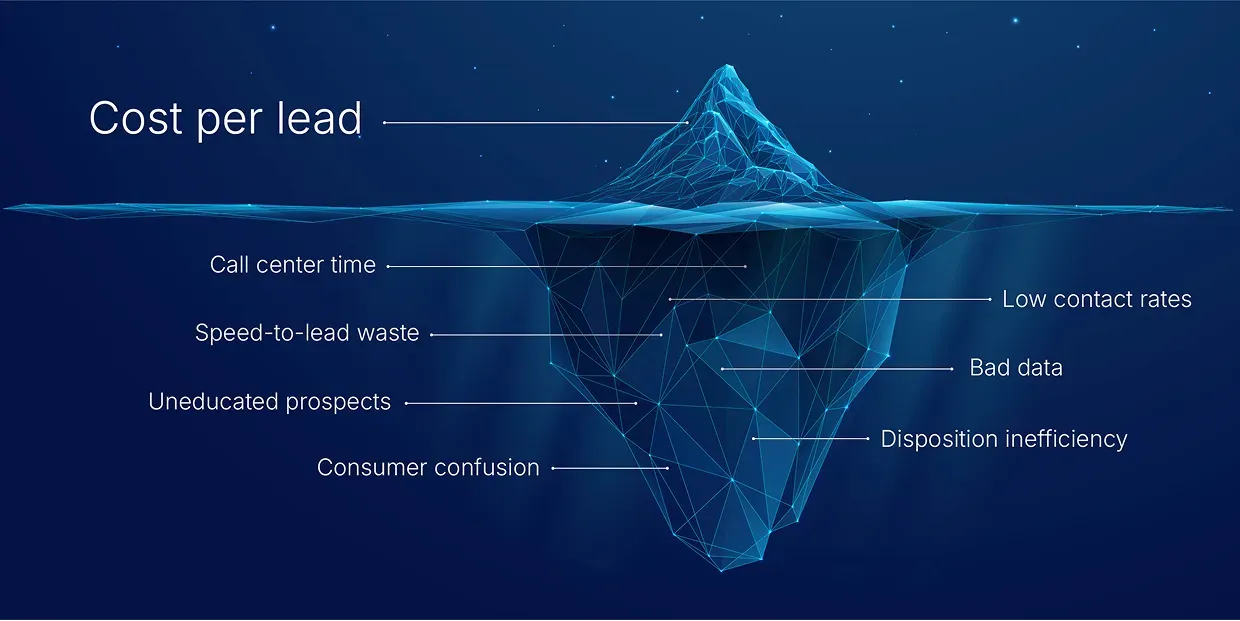

These inefficient leads bog down call centers with low-probability conversations. They depress contact rates by creating noise. They distort CRM data, making it harder to model downstream value. And they confuse consumers who think they’re filling out one form and end up getting hammered by multiple brands.

But, unfortunately and importantly, the more sophisticated the operator is, the higher the cost of shared lead inefficiency. The more data points a buyer uses to predict the behavior of their lead funnel, the more they feel the pain of an inefficient shared lead.

Companies with national scale—the ones with centralized teams, large CRMs, standardized workflows, and tight KPIs—feel the pain the most.

When you’re operating in 40+ states and calling leads within seconds, you are not running the same business as a local shop. Your system requires:

- Clean data

- Clear attribution

- Predictable outcomes

- Stable source performance

- A 1:1 relationship between consumer intent and buyer action

That structure collapses when one homeowner's information is sold four times and every operator must fight for the first dial. Exclusive leads don’t exist because they’re “better”, they exist because they preserve the data clarity national systems depend on.

The bottom line: shared leads will continue to grow.

The economics are too attractive for suppliers to ignore. But the brands who win in this new market are not the ones who accept more volume at lower cost. They’re the ones who insist on clarity, protect their systems from noise, and partner with agencies who understand the structure required for performance at scale.

This is the challenge Converge was built for.

Converge has always operated in the conditions the consolidated home-services landscape now demands. Our model was designed for high-volume, multi-state, data-heavy operations. When it comes to ecosystems that are rigorous, complex, and unforgiving to noise… we thrive.

Not because it sounds good in a deck, but because we know that national-scale performance only works when:

- Quality and compliance are enforced at the source

- Every lead is exclusive, proof of consent is verified, dupes and DNCs are rejected in real time, and upstream suppression is non-negotiable.

- Operations are aligned from lead to call outcomes

- Call-center congruity is maintained, disposition-level data feeds optimization, and performance is managed at the outcome (not just the volume) level.

- Partnerships are held accountable

- Communication is tightly managed, incentives stay clean, and accountability is built into every relationship.

As consolidation across the home services industry accelerates, the question is no longer “are shared leads good or bad?”. The question is “can my operation absorb the inefficiency shared leads create?” and for national players, the answer is increasingly no.

Here at Converge, we know your brand’s systems, people, call centers and KPIs all perform better when the top of the funnel is clean, exclusive, and predictable.

Ready to stop leaving growth on the table? Contact our lead generation team today to discuss where we can cut out inefficiencies in 2026.